Most private M&A transactions are structured as acquisitions of stock, rather than mergers or asset purchases. The principal agreement governing such a transaction is typically a Stock Purchase Agreement (SPA), sometimes styled a Securities Purchase Agreement or simply a Purchase Agreement. At their most basic level, these agreements provide for the sale of shares in a target company to a buyer in return for cash or some other form of consideration (i.e., something of value). However, M&A transactions are anything but basic. They are riddled with substantial risk and potential rewards for both parties, and SPAs often become quite complex in an effort to address the many ways M&A deals might go wrong.

In this post, I’ll introduce you to the key provisions of an SPA and explain their purposes. In later posts on The M&A Lawyer Blog, I will examine each of these sections more closely and provide a more detailed and nuanced discussion of their contents.

If you’d like to compare my discussion with a sample Stock Purchase Agreement, here‘s the SPA that governed AT&T’s attempted (and ultimately abandoned) acquisition of T-Mobile from Deutsche Telekom for $39 billion in 2001. You’ll notice some discrepancies between my references to Articles of the SPA and the Articles of the AT&T / Deutsche Telekom agreement. Although agreements like these do conform to customary standards and structure, variations do exist. Please keep that in mind as you read on.

Want to buy a stock purchase agreement?

Preamble and Recitals

The first paragraph of an SPA is known as the Preamble. It usually names the agreement, introduces the parties and sets forth the effective date of the contract. More often than not, it will also create defined terms for each of these, such as the “Seller” and the “Purchaser.”

Immediately after the Preamble, the Stock Purchase Agreement often contains a series of statements beginning with the word “WHEREAS”. These are known as the Recitals. Unlike most of the rest of the agreement, the Recitals are not generally meant to be binding on the parties. Instead, they lay out the intentions of the transacting parties and provide context to anyone later attempting to interpret the SPA.

Article 1: Definitions

Article 1 of most SPAs provides an alphabetical list of definitions of important (usually capitalized) terms used throughout the agreement. These definitions do not function as stand-alone terms and conditions but are instead incorporated into other operative provisions throughout the contract. For example, Article I might provide definitions for the terms “Acquired Shares,” “Encumbrance” and “Environmental Law.”

Although you may be tempted to gloss over these definitions thinking they are immaterial boilerplate or difficult to make sense of devoid of context, they are critically important and may substantially alter the effect of the provisions in which they are used. Some, such as “Liabilities,” “Material Adverse Effect” or “Seller’s Knowledge” (or their equivalents) are used throughout the contract and may be the subject of extensive negotiations.

In addition to the list of definitions, this Article will frequently also contain cross-references to terms that are defined elsewhere in the Stock Purchase Agreement and a section devoted to rules of construction applicable to the contract.

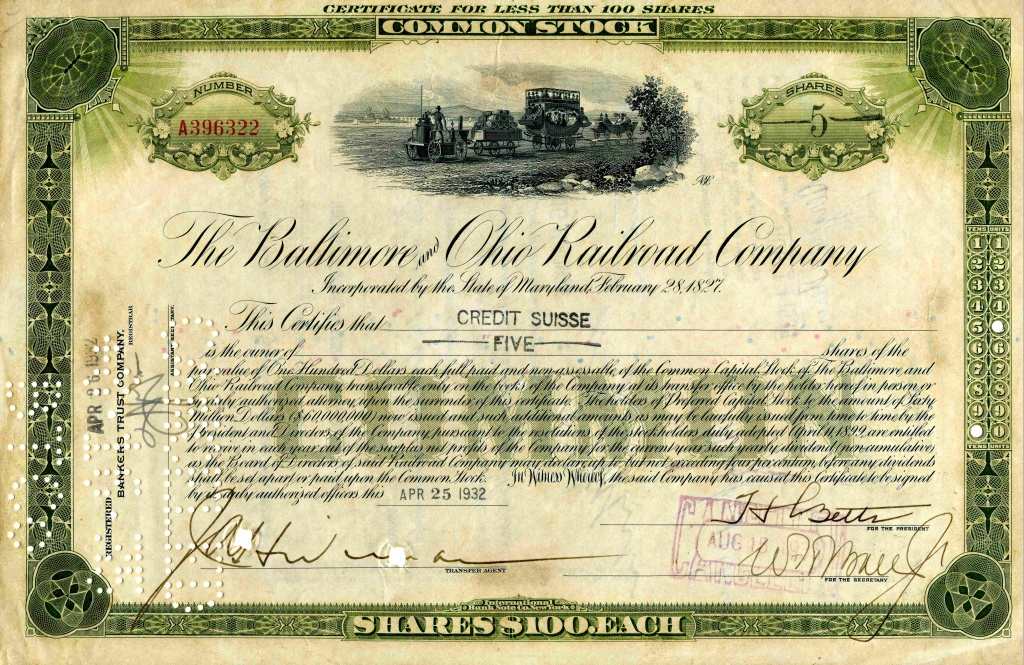

Article 2: The Transaction

Article 2 of a standard SPA will usually provide the specific terms of the sale of the stock. It contains language to the effect of “the Seller will sell and transfer to the Purchaser, and the Purchaser will purchase and acquire from the Seller, all of the Shares.” It also sets forth the purchase price, any purchase price adjustments (such as an adjustment to account for variations in target net working capital at closing) and documents and other things that must be exchanged between the parties at closing. These will include the purchase price and share certificates, of course, as well as legal opinions, any employment agreements, any escrow agreement and other ancillary documents.

Article 3: Seller Representations and Warranties

Article 3 of most Stock Purchase Agreements contains representations and warranties from the seller about itself and the target company. As discussed in a prior post, representations and warranties are statements of past or present fact relating to the business, assets, liabilities, properties, condition, operating results, operations and prospects of a subject company or set of assets made by one party to an M&A transaction to another. Inaccurate representations and warranties may result in the incurrence of liability by the party that made the statements.

Here’s a long list of subjects that may be addressed by seller representations and warranties:

- organization and good standing

- authority and enforceability

- absence of conflicts

- capitalization and ownership

- subsidiaries

- financial statements

- books and records

- accounts receivable and accounts payable

- inventories

- absence of undisclosed liabilities

- absence of certain changes and events

- assets

- real property

- intellectual property

- material contracts

- tax matters

- employee benefits

- employment and labor

- environmental, health and safety

- compliance with law

- legal proceedings

- customers and suppliers

- product warranties

- product liability

- insurance

- related-party transactions

- guarantees

- brokers and finders fees and

- full disclosure.

Few, if any, transactions will include all of these representations and warranties, and many of them overlap at least in part.

Article 4: Buyer Representations and Warranties

Article 4 usually contains reciprocal representations and warranties from the buyer to the seller. (Occasionally, these are included within another section of Article 3 along with the seller representations and warranties.) If the buyer is issuing shares as all or part of the purchase price, then its representations and warranties will mirror those of the seller fairly closely. More often, though, the buyer is paying cash and its representations and warranties are consequently significantly more limited in scope. After all, cash is cash.

Buyer representations and warranties frequently cover some combination of the following topics:

- organization and good standing

- authority and enforceability

- absence of conflicts

- governmental consents

- legal proceedings

- investment intent

- financing

- brokers and finders fees and

- independent investigation.

Article 5: Covenants

Assuming your deal has a gap period between signing and closing, as most do, Article 5 of the SPA will contain covenants (i.e., promises to do or refrain from doing something) from the parties governing their activities during this time as well as after closing.

There’s usually an “Access and Investigation” covenant through which the seller promises to permit the buyer to access the acquired business and its books and records prior to closing. Among other things, this enables the buyer to continue planning for and implementing its integration of the acquired business during the gap period.

This Article will also require the seller to operate the acquired business prior to closing in the ordinary course consistent with past practices. Such provisions sometimes include long lists of specific actions required to be taken (or prohibited from being taken) by the seller. Generally speaking, the more comprehensive and specific the list, the more favorable it is to the buyer. These conduct of business provisions help preserve the business in the form expected by the buyer and maintain it in a condition that is similar to what it investigated through due diligence.

In addition, Article 5 usually requires the seller to notify the buyer of certain material developments impacting the acquired business or the transaction. The goal here is not only to ensure real-time information flow to the buyer about its soon-to-be-owned business, but, depending on how the provision is written, to enable the buyer to declare a material breach of the SPA or failure of a closing condition if it has been notified of a breach or failed condition.

Article 5 will generally also contain a covenant requiring the parties to exercise certain efforts to consummate the transaction, including obtaining regulatory approvals and securing third part consents.

Other covenants you may encounter in Article 5 include provisions governing confidentiality, no-shops, public announcements, preparation of interim financial statements, seller cooperation with financing, customer communications, employee matters and indemnification and insurance.

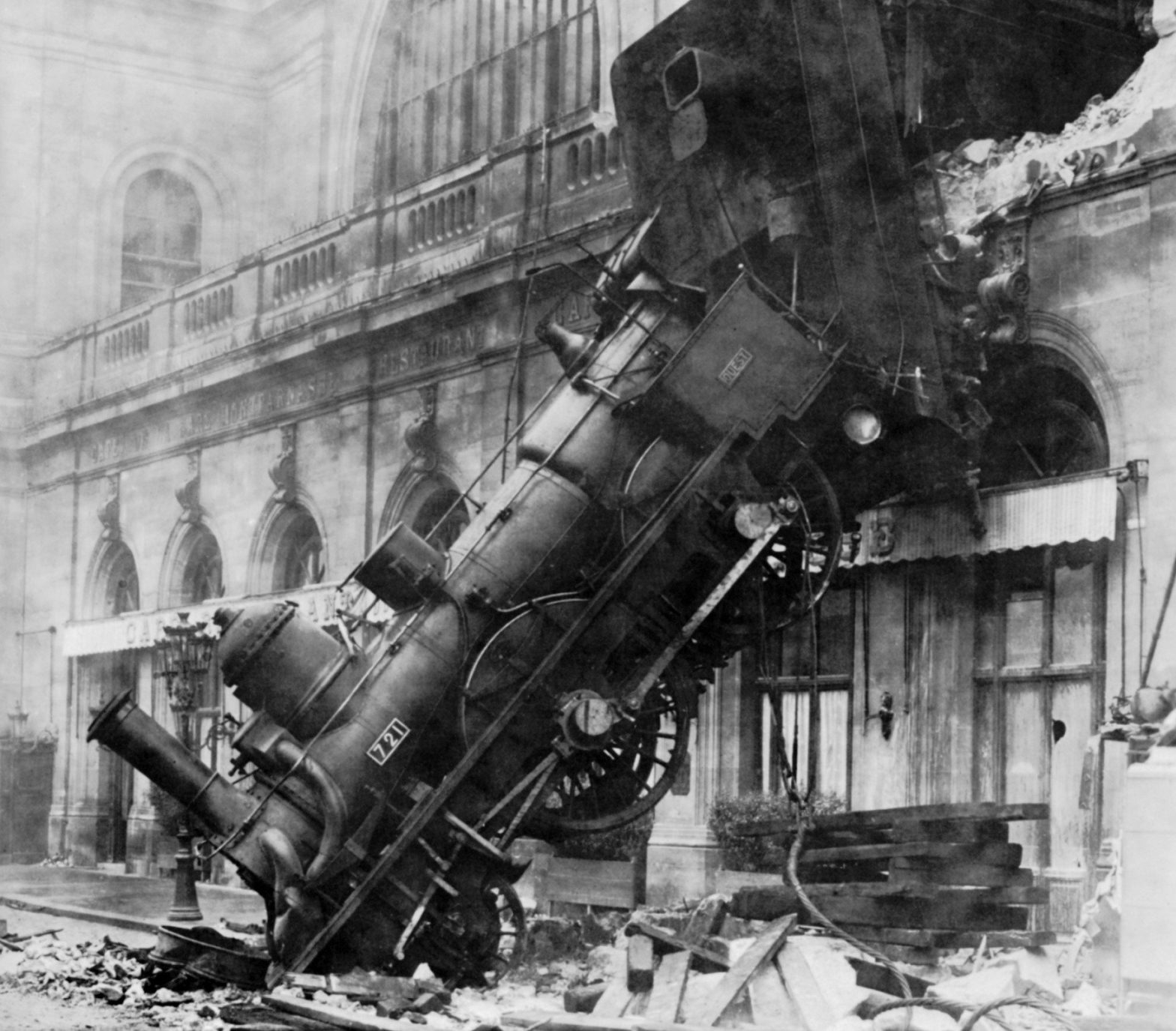

Article 6: Closing Conditions

Again assuming the deal has a gap period between signing and closing, the Stock Purchase Agreement will include conditions precedent that must be satisfied or waived before each party will be required to consummate the transaction. Among other things, these will generally require that the other party’s representations and warranties will have been true when made and remain true at closing, and they will require that the other party will have complied with its pre-closing covenants. As you might expect, all required regulatory approvals and third party consents will need to have been secured, as well. Frequently, a buyer will also require as a condition precedent that the acquired business will not have experienced a material adverse change—an adverse change in the target’s business that is consequential to the company’s long-term earnings power. Occasionally, a buyer may be able to negotiate for a requirement that it will have satisfactorily completed its due diligence examination of the target, too.

Article 7: Indemnification

Another SPA Article will provide for indemnification rights, which entitle each party to be compensated by the other for losses suffered on account of a breach of any of the other party’s representations, warranties and covenants. Indemnification may also be extended to losses arising from specific causes, such as an identified environmental condition.

This Article will not only outline each party’s basic rights to indemnity. It also usually:

- establishes a survival period for representations and warranties after which claims for breach cannot be brought,

- sets limits on indemnification, including a threshold or deductible and a cap,

- if applicable, outlines the use of any funds deposited in escrow for indemnification,

- lays out procedures to be followed to make indemnification claims and to handle third party claims,

- indicates the extent to which indemnification is a party’s exclusive remedy for breaches and

- clarifies how losses should be calculated for purposes of any recovery.

Article 8: Termination

The conditions to closing contained in Article 6 would be pointless without a corresponding right to terminate the SPA and the transaction if any of those conditions aren’t satisfied or waived. Every SPA thus contains an Article describing each party’s termination rights, which often include not only termination due to failure of a condition but also termination by mutual consent, termination by the buyer if the target company has suffered a material adverse effect, termination by either party if the transaction is enjoined or fails to obtain necessary governmental or third party consents or termination by either party if the deal hasn’t closed by a specified deadline.

In addition, this Article explains the effect of termination, usually that some provisions of the SPA will survive termination (e.g., governing confidentiality and miscellaneous provisions), that one party may owe a termination fee or expense reimbursement to the other and that the parties will remain responsible for any pre-termination breaches.

Article 9: General Provisions

Finally, virtually every SPA will contain an Article dedicated to miscellaneous provisions governing a variety of subjects, including expenses, governing law, notice, dispute resolution, expenses, severability, counterparts, assignment, amendment and more.

Other Articles

Aside from the more common sections described above, many Stock Purchase Agreements contain Articles devoted exclusively to other topics, including taxes, employment and labor and environmental matters. Such additional Articles will usually only appear in an SPA if their subject matter is particularly important and requires a more fulsome approach than it would otherwise receive.

* * *